Payment Methods to Support Local Buyers Worldwide

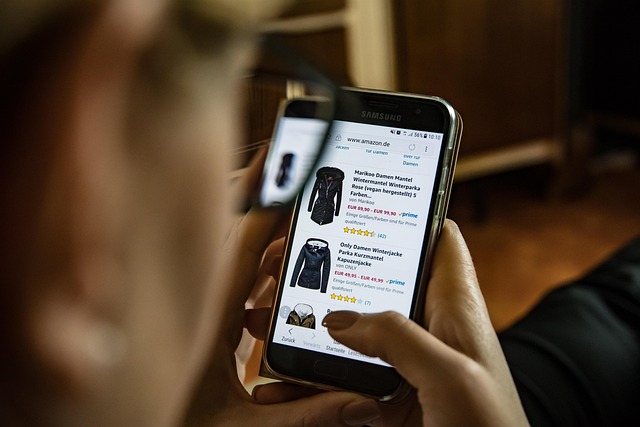

Adapting payment methods for local buyers boosts conversion and trust across borders. This article outlines practical payment strategies, mobile-friendly options, and how localization interacts with logistics, customs, and returns to support global ecommerce.

Consumers expect familiar and frictionless payment experiences when shopping across borders. Merchants that tailor payments to local expectations—offering the right mix of wallets, bank transfers, card options and checkout flows—can reduce abandonment and improve conversion. This article explains practical payment considerations for ecommerce sellers, covering localization, currency handling, gateways, tracking, returns, logistics, mobile needs, personalization, analytics and sustainability.

How does localization affect ecommerce payments?

Localization goes beyond translating text: it aligns payment options with regional habits. In some markets, digital wallets dominate; in others, cash-on-delivery or local bank transfers are preferred. Offering localized payment methods and localized prices in local currency signals familiarity and reduces friction at checkout. Merchants should map preferred methods by market, integrate local gateways or partners, and display clear localized policies for taxes, customs, and returns so buyers understand total landed cost before paying. Proper localization also supports trust indicators like local payment logos and local customer service channels.

What checkout options reduce cart abandonment?

A streamlined checkout directly impacts conversion. Mobile-optimized single-page checkouts, guest checkout, one-click or tokenized card payments, and support for local wallets all shorten the path to payment. Personalization—pre-filling addresses and suggesting familiar payment options—can decrease errors and speed completion. Security measures such as 3D Secure should be balanced with UX to avoid unnecessary steps. Analytics can reveal where users drop off, enabling targeted improvements: A/B testing payment flows, simplifying forms, and offering saved payment methods for returning customers are practical tactics.

How to handle currency and crossborder fees?

Displaying prices in the buyer’s currency reduces confusion and lowers perceived risk. Multi-currency pricing, dynamic currency conversion, or transparent currency selection at checkout are viable approaches. Merchants must account for FX spreads, processor crossborder fees, and potential chargeback costs when choosing gateways. Clear communication about who bears customs duties and VAT at checkout prevents surprises. For high-value orders, consider pre-authorizations or split payments to manage risk. Use analytics to measure the impact of currency display options on conversion and adjust pricing or fees accordingly.

How to integrate gateways and tracking for transparency?

Choosing payment gateways should be based on coverage, local method support, fee structure, and integration capabilities. Well-integrated gateways offer webhooks, transaction status updates, and reconciliation tools that feed tracking and analytics systems. Combining payment status with logistics tracking provides customers with a unified view of order progress and refunds. Implementing consistent tracking identifiers across payment, order management, and shipping systems supports faster dispute resolution and clearer financial reporting. Prioritize providers that support local payment schemes, strong reporting, and easy integration into your analytics stack.

How do customs, returns, and logistics influence payment choices?

Customs duties and return policies affect buyer willingness to pay upfront. Offering options like delivery duties paid (DDP), or allowing customers to choose who pays duties, can reduce abandoned carts on crossborder orders. Returns workflows influence refund timing and the choice of payment methods: some payment providers support partial refunds, delayed refunds, or hold periods useful for international returns and inspections. Logistics partners that provide tracking and clear timelines make it easier to align refund rules with actual transit times. Consider payment holds or escrow for high-risk shipments until customs clearance or return windows close.

What role does sustainability and mobile play in payment experience?

Mobile-first payments and mobile wallets are essential as mobile commerce grows in many regions. Optimizing checkout for mobile screens, offering quick-pay wallet options, and supporting local mobile money systems can increase reach. Sustainability considerations—digital receipts, carbon-aware shipping choices, or highlighting low-carbon delivery options—are increasingly relevant and can be surfaced during checkout and payment selection. Personalization and analytics allow merchants to present eco-friendly options to interested buyers while maintaining fast mobile payment flows that keep checkout friction low.

In summary, supporting local buyers worldwide requires a coordinated approach across payments, checkout design, currency presentation, logistics, customs handling, and returns. Selecting gateways that support local methods, integrating tracking and analytics, and optimizing mobile and personalized experiences all contribute to smoother crossborder commerce. Thoughtful localization and clear communication about fees and delivery expectations help build trust and reduce friction for international buyers.